Worldwide Public Cloud Infrastructure as a Service Market Shares, 2022

Investments in High-Performance Services Create Differentiation

EXECUTIVE SUMMARY

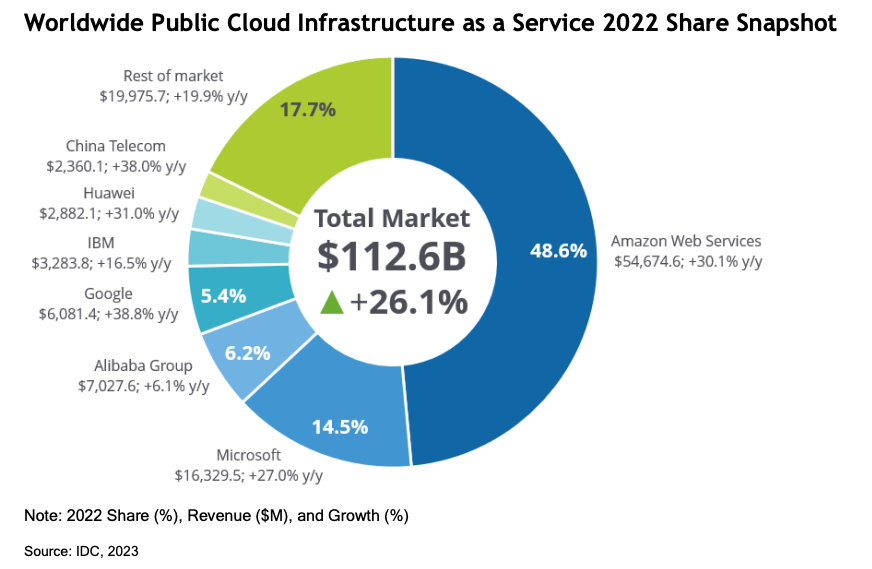

The public cloud infrastructure-as-a-service (IaaS) market grew 26.1% in 2022 to $112.6 billion. Amazon Web Services (AWS) remains the market share leader in the worldwide public cloud infrastructure-as-a-service market, at $54.7 billion, representing 48.6% of global market in 2022. Microsoft, Alibaba, and Google are the next largest providers, with 14.5%, 6.2%, and 5.4% market shares, respectively. Overall, the top 4–5 vendors in the public cloud IaaS market continue to extend their share leads, as public cloud IaaS becomes increasingly difficult for new market entrants to penetrate. In 2022, the top 5 public cloud IaaS providers accounted for over 77% of the total market spend. Throughout 2022, IaaS leaders such as AWS, Microsoft, and Google all drove significant investments in core compute and storage services, expanding their portfolios to meet growing customer demand and anticipate the needs of an increasingly mature cloud user base. We also saw leading providers invest heavily to expand their dedicated cloud IaaS solutions, which have quickly become integral, complementary assets to their core public cloud offerings. Adoption of these services has been driven by customer propensity to adopt “hybrid cloud” strategies including both public, multitenant services and dedicated, single-tenant services. Adoption is also driven by the need for increasingly localized and performant cloud storage and compute resources for “edge” use cases. The investment in supporting AI/ML workloads infrastructure and multicloud-focused services and features grew throughout 2022. These trends are discussed at length in this study. IDC defines public cloud IaaS as the aggregate of the compute, the raw ephemeral and persistent storage capacity, and the associated network capability, delivered through a public cloud deployment model — as described in IDC's Worldwide Public Cloud Infrastructure as a Service Taxonomy, 2023 (IDC #US50402323, June 2023). The compute and storage components of this market are tracked in IDC's Worldwide Semiannual Public Cloud Services Tracker.